College and career readiness is a frequently used metric in schools and in the postsecondary access field. But how is readiness defined? And what steps can schools take to help pave the way?

A Guide to the New Better FAFSA: Everything You Need to Know

By Monica Selagea

September 22, 2023

Navigating the ‘Better FAFSA’ Changes: A Step-by-Step Guide for a Smooth Application Process

The thought of attending college or continuing to a different postsecondary path can be stressful, but perhaps even more daunting is paying for your chosen path. Luckily, not all colleges have the same sticker price and tuition fees do vary, but college costs overall are on the rise because of inflation and cuts to state funding, among other factors. For students from low-income communities and their families, affording a college education can be a remarkable financial challenge. That is why the Free Application for Federal Student Aid, better known as FAFSA, is imperative to understand and complete during a student’s senior year.

What is FAFSA?

FAFSA is a federal financial aid program that connects students who want to pursue a higher education with financial assistance like federal, state, and institutional aid. Correctly completing and submitting the application is a significant pathway to receiving financial support and can alleviate the financial burden of college costs. The amount offered varies since the funding is provided by the federal and state governments, and/or colleges. For example, Illinois students who are eligible can receive a maximum federal and state amount of approximately $16,000 for the year. To be eligible for FAFSA, a student must demonstrate financial need, be a US citizen or eligible noncitizen, have a valid Social Security number, and be accepted or enrolled in an eligible degree or certificate program.

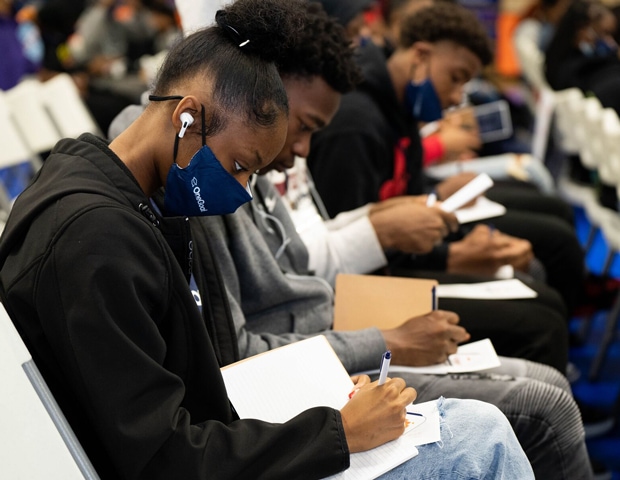

OneGoal Program Directors spend countless hours preparing students for FAFSA opening day as part of the three-year program. Parents are also involved in the process to ensure a successful submission. Navigating through the FAFSA process is overwhelming, but it’s a pivotal step in making higher education a reality for our students.

Who Meets the Requirements?

The aid students receive varies depending on a student’s income, financial situation, and certain household information. Once these details are assessed and calculated, the student will be eligible to receive a specific amount of aid from the federal and state governments. Colleges will also use this federal and state aid information, among other factors like student GPA and SAT scores, to determine how much aid to offer students. If the student is in financial need, is a citizen or an eligible noncitizen, and is enrolled (or will be enrolled) in a degree or certification program at a college or career institution, they are eligible to receive aid. Educators, counselors, parents, and students can use a student aid calculator to estimate their aid.

Typically, at the beginning of a student’s senior year, high school counselors assist with financial aid. This can be done through one-on-one sessions with students, parent meetings, or in a classroom setting. Parents should reach out to their student’s counselor if they have concerns or unique situations that require sensitivity or further guidance. In Illinois, for example, all high school students must complete the FAFSA in order to graduate, unless they’re undocumented. Undocumented students in Illinois and a few other states complete an alternative financial aid application. Completing the FAFSA is not only mandatory for students in Illinois, but also essential for accessing aid. However, it can be an exacting process, so high school counselors should try their best to teach and guide students to comprehend the process. Students having this understanding is valuable since they will complete the FAFSA every year while in college.

A OneGoal Fellow recently shared his experience with completing the FAFSA: “Even as I think of reapplying for FAFSA next year, I know it’s going to be different than the first time around because now my mom is going to work again and so I’ll likely get less aid. But I now know how to look for the best scholarships for me. So when FAFSA opened up on Oct. 1, I finished it on the 2nd. Now I’ll be talking with friends from college about whether they’ve completed it and they don’t know anything about it, let alone that it was something they’d have to complete and get done! It feels really good that I don’t have to be behind or wondering, ‘am I going to get as much aid as I need,’ because once you become an expert in it, filling it out year after year isn’t that scary.”

When Does the FAFSA Application Open?

Good news! The Better FAFSA is now open, but it is currently on a soft launch for the 2024-2025 school year. In other words, it is only available periodically and the U.S. Department of Education recommends that students and parents try at a later time if the application is not available. This is to ensure that there are no technical issues. According to FAFSA, there is plenty of time to complete the application for financial assistance.

What’s Changing with the Better FAFSA?

According to Federal Student Aid, the Better FAFSA will translate to a more streamlined process, increased eligibility for grants, and reduced barriers for some student populations. The number of questions will be reduced and there will be a reduction in colleges requesting verification of financial information, which will allow more students to gain access to the financial aid they need to attend college.

Major changes to the 2024–25 FAFSA form include the following:

- A roles-based FAFSA form

- The roles are student (applicant), parent, and preparer.

- Once all required data has been provided and all sections have been signed, any role can submit the FAFSA form.

- Introduction of contributors to the FAFSA form

- Contributors can be parent, other parent, student spouse, or student (when invited by a parent). Contributor is a new term introduced on the 2024–25 FAFSA form. It refers to anyone (the student, the student’s spouse, a biological or adoptive parent, or the parent’s spouse [stepparent]) who is required to provide their information and signature on the FAFSA form. All contributors must also provide consent and approval to have their federal tax information transferred from the IRS directly into the FAFSA form. Contributors are not responsible for paying for the student’s education costs.

- Contributors must provide the required information and sign their respective section for a FAFSA form to be considered complete.

- A FAFSA onboarding experience for both initial entry and correction entry

- Integration of the FAFSA form into StudentAid.gov’s Dashboard, Status Center, Notification Center, and Settings

- The general look and feel of the FAFSA form

- Integration to allow users’ federal tax information to be retrieved and transferred directly into the FAFSA form via IRS direct data exchange, replacing the IRS Data Retrieval Tool

- Replacement of the Expected Family Contribution (EFC) with the Student Aid Index (SAI)

- Required consent from users for the following:

- retrieve and disclose federal tax information,

- be eligible for federal student aid, and

- be eligible to receive an SAI.

- Predictive search results for questions that require city, state, or school lookup

- A requirement that students invite their parent(s) to contribute to their form if parent information is needed

- A requirement that independent students and a dependent student’s parent invite their spouse to contribute to the student’s form if spouse information is needed

- A requirement that students and contributors provide consent to retrieve and disclose federal tax information from the IRS for the student to be eligible for federal student aid

As an educator and OneGoal Program Director who prepares students for their postsecondary path, I think this is great news! Currently, counselors, staff, and educators, like myself, are attending professional development to learn about the changes so we can provide knowledgeable assistance. We remain optimistic about the opportunities this change can offer to more students who want to attend college, and hope it eliminates stressful financial setbacks.

Being Prepared

There are several factors that determine a student’s eligibility in receiving aid, but the family’s income, assets, and household size are the main criteria that are assessed. To start the process, counselors may ask students to bring in their parents’ taxes from the previous year. For example, for this year’s application, students must have their parents’ filed Federal taxes and W-2s from 2022. If the student worked and filed federal income taxes, they must also have their documents handy. This is sensitive information and your student’s counselor should be respectful of each family’s situation. Parents should be able to trust that the student’s counselor will handle this process with care. It is absolutely normal to ask the counselor questions about the FAFSA or why they are requesting that you or your student complete certain tasks.

Creating an FSA ID

Beginning in the 2024–25 award year, everyone contributing to the FAFSA form online must have their own StudentAid.gov account. This can be created at the Federal Student Aid website by choosing “New to the FAFSA.” Each contributor, including the student, will access their StudentAid.gov account by using their FSA ID (account username and password). Parent(s) and other contributors (not including the student) without a Social Security number (SSN) will be able to create a StudentAid.gov account to fill out and sign their section of the student’s FAFSA form online. Students will need to provide their SSN to create their StudentAid.gov account. With the Better FAFSA, undocumented individuals will complete alternative steps to verify their identity. The process to create an FSA ID can take several minutes, but it is mandatory in order to submit the FAFSA application. It will take one to three days for an FSA ID to go through the verification process. Plan on setting up an FSA ID at least one week prior to starting the FAFSA.

Step-by-Step Guide to the FAFSA application

After the FSA ID(s) are verified, you can begin the application. In the past, the student and parent would complete the application together. With the Better FAFSA changes, the student will now complete the FAFSA individually and invite the parent to contribute to the student’s application. The parent will complete the parent section individually. The student should be present with the parent to ensure all the information is accurate. The parent(s) and student should work together in the financial investment for the student’s future. Students need to choose the correct school year, keeping in mind that they are completing the FAFSA for the following year. For example, if the senior is completing the FAFSA this academic school year (2023-2024), their postsecondary academic school year will be 2024-2025. This means that FAFSA will calculate eligibility for two semesters: fall 2024 and spring 2025.

Better FAFSA Changes: Getting Started!

Student Section

Each application is individualized; however, for the purpose of being prepared, the following examples will be for a student who is “Dependent.”

On the first page, students are directed to “Start a New Form.” After logging in with FSA ID, the student will be directed to an “Onboarding Page” which provides an overview of the FAFSA form and an accompanying video. These pages will provide information about the different roles that may be required to participate in the student’s FAFSA form, as well as information about the types of questions the student can expect to see. It will also show how the student can get additional help with filling out the FAFSA form including documents that may be needed to fill out as well as what to expect after submitting the FAFSA.

Within the Student Section, there are subsections: Personal Circumstances, Demographics, Financials, Colleges, and Signature.

Personal Circumstances

This section pertains to the student’s personal information such as student identity, legal residence, consent, personal circumstances, and marital status. The student can verify that their information is correct. To update any of the personal information, the student must access their Account Settings on StudentAid.gov. For fields related to the student’s mailing address, the student can edit them directly on this page. As the student is considered dependent, they are asked to provide information about their parents.

If the student filed taxes, the consent section informs the student about consent and their federal tax information. By providing consent, the student’s federal tax information is transferred directly into the FAFSA form from the IRS to help complete the Student Financials section. The student selects “Approve” to provide consent and is taken to the next page. If the student did not file their taxes or did not work, the student can dismiss this section.

The FAFSA form considers their “Parent” to be their legal (biological or adoptive) parent. The student is asked if their parents are married. The student selects “Yes” and is required to invite their parents to their FAFSA form to complete the required parent sections. The student is asked to enter personal information about their parents in order to send them an invite to their FAFSA form.

Student Demographics

The student is asked about their gender identity and if they are transgender. The student is then asked if they are of Hispanic, Latino, or Spanish origin. They are also asked about their race. The student selects checkboxes to answer both questions. The student is asked about their citizenship status. The student selects the “U.S. citizen or national” option. Demographic questions about the student’s gender, race, and ethnicity have been added to the FAFSA form. These questions are for research only and do not affect federal student aid eligibility. They are asked a few more questions about their parents and will end with the student’s high school information such as completion status.

Student Financials

The student is asked questions about their 2022 tax return. The student enters a response in each entry field along with information about their assets.

Student Select Colleges

This section is vital for the student to complete. Here, the student is able to choose up to 20 schools. These are the schools that the student is considering to attend and therefore is applying for aid. Should the student decide to change schools, it can be modified even after submission. Counselors advise students to add as many schools as possible to ensure that aid will be distributed to one of the schools listed should the student be accepted. Students can add the school using the schools’ Federal Code or by using the drop-down menu to search the school by city and state. For each school, the student must indicate if they will be living on campus, off campus, or with a parent. This can determine eligibility and can also be modified if the student reconsiders after submission.

Student Signature

After a section of reviewing if the student information is correct, the student will then acknowledge the terms and conditions of the FAFSA form and sign their section. After agreeing and signing, the student is able to submit their section of the FAFSA form. Since parent information has not been provided, the FAFSA form is not considered complete and can’t be processed yet.

Parent Section

The parent will receive an email from FAFSA to contribute to the student’s FAFSA application. The parent can “Log In” to FAFSA using the link provided in the email. The parent should now begin the parent section. After successfully logging in with the parent’s personal FSA ID, the parent is taken to their “My Activity” page. The parent sees an invitation to be a contributor on the student’s FAFSA form. Parents are also taken to the “Onboarding Page” and will review a few sections of the same information that was provided for the student.

The parent subsections are: Demographics, Financials, and Signature.

Parent Demographics

These sections pertain to the student’s parent personal information such as identity, legal residence, consent, and marital status. The parent can verify that their information is correct. The consent section informs the parent about consent and their federal tax information. By providing consent, the parent’s federal tax information is transferred directly into the FAFSA form from the IRS to help complete the Parent Financials section. The parent selects “Approve” to provide consent and is taken to the next page.

Parent Financials

This page has several questions. It asks the parent if they or anyone in their family has received federal benefits. The next page will ask the parent about their tax filing status. It will ask about family size, and the number of people that will be in college between July 1, 2024, and June 30, 2025. It will ask about tax return, parents assets, and about information about the other parent. Be prepared to answer every question carefully and accurately. Every question answered plays a role in how much aid the student will receive.

Parent Signature

The review page displays the responses that the parent has provided in the FAFSA form. The parent can only view responses within the parent section of the student’s FAFSA form. The parent can view all their responses by selecting “Expand All” or expand each section individually. To edit a response, the parent can select the question’s hyperlink to be taken to the corresponding page. Finally, the parent acknowledges the terms and conditions of the FAFSA form and signs their section. Since all required sections are complete, the parent can both sign and submit the student’s FAFSA form. This is why it is imperative that the student and parent are together when completing the application.

After Submitting the Application

Students and parents will receive an email from Federal Student Aid stating that the application has been submitted. An estimated amount of aid will be available to view in the Student Aid Index or SAI immediately after submission. The schools the student listed on the FAFSA will use the information from the FAFSA to determine eligibility. Federal aid will be part of the student’s financial award letters sent during the spring, after a student has been accepted to the universities.

The beauty in submitting the application is that a student can modify or make changes even after the application has been submitted if they think they made a mistake or for any changes in the School section. Students are allowed to change their mind if they consider other schools listed on the FAFSA form and should change them promptly to ensure the aid will be received by the school.

Expected Family Contribution vs Student Aid Index

In the past, aid was based on the EFC. This is a number that college financial aid staff use to calculate how much aid to give to students. The EFC is calculated according to a formula established by law. The student family’s taxed and untaxed income, assets, and benefits (such as unemployment or Social Security) all could be considered in the formula. Also considered are your family size and the number of family members who will attend college or career school during the year. College financial aid staff use the following formula to calculate aid: Cost of Attendance – EFC = Financial Need. Colleges use a combination of grants, scholarships, and loans to meet the student’s calculated financial need. The higher a student’s EFC, the less free money (grants and scholarships) and more loans a student will receive. With the Better FAFSA, a Student Aid Index (SAI) will determine a student’s eligibility for aid. Use of the SAI will begin for the 2024-2025 award year. The SAI replaces the Expected Family Contribution (EFC) in the calculation to determine eligibility for need-based funding. The formula is: Cost of Attendance – Student Aid Index – Other Financial Assistance = Financial Need.

A Smooth FAFSA Application

For first-time applicants, a student’s counselor, trusted educator, or OneGoal Program Director should assist the student and parent with the application process. Submitting the application shouldn’t take more than 30 minutes to an hour with guided assistance; however, the student and parent must be fully prepared. With the new changes, the process should be easier. Nevertheless, it’s important to follow the aforementioned steps to be ready for any changes FAFSA may have forthcoming.

Monica Selagea grew up in Chicago and attended Columbia College in Chicago and DePaul University. She is currently a high school teacher in Chicago and a Program Director for OneGoal. She also teaches at the City Colleges of Chicago.

Related Stories

Delve into the complexities of the achievement gap, strategies to bridge it, and the profound importance of preparing students for their future path with the right skills and knowledge.

How can we match students with colleges and other pathways that align with their personal and professional goals? Which institutions are supporting the social-emotional needs of students? And more.